Estate Planning: Why You Should Begin Now

If you’re wondering when the right time to start estate planning is, the answer is simple: it’s now. Our comprehensive guide will explain the importance of estate planning and why you should begin sooner rather than later.

Have you thought about what will happen to your assets and belongings after you’re gone? While it may not be a pleasant topic, having the right estate plan ensures that your end-of-life wishes are followed and your loved ones are taken care of.

So, when should you start thinking about estate planning? By paying attention to certain milestones in life, you can determine when to address each aspect of your estate planning needs, such as nominating a guardian, making a will, creating a trust, and updating your estate plan.

When is Estate Planning becoming necessary?

Financial advisors recommend starting estate planning once you become a legal adult and regularly updating it every three to five years thereafter. This is because, as a young adult, you become responsible for your finances, healthcare, and power of attorney. However, it’s normal for estate planning to be the last thing on your mind at this stage of life.

Nevertheless, certain life events should never be ignored when prioritizing your estate plan. Regardless of your age, consider the following circumstances as signs to start or update your estate plan:

- Opening a savings account: When you begin saving, it’s vital to designate where those funds should go in the event of your death.

- Home and property ownership: Purchasing a home or additional property indicates the need for estate planning to avoid lengthy probate court proceedings.

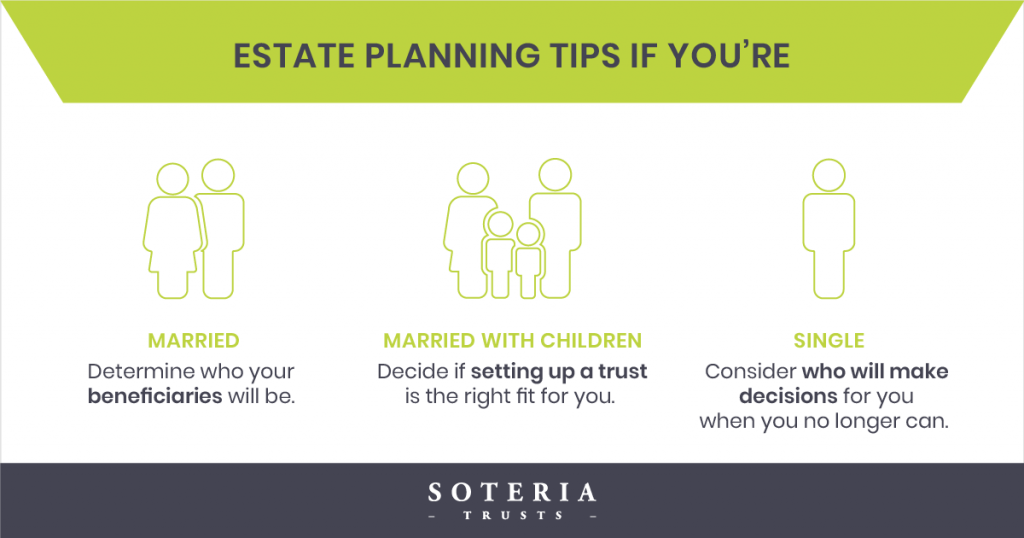

- Marriage and remarriage: Combining assets requires careful consideration of what happens in the event of one or both spouses’ deaths.

- Travel: Updating your estate plan is recommended before embarking on big trips, especially long-term or frequent travel.

- Having a child: The birth of a child is a significant trigger for estate planning, as you need to think about guardianship and financial security.

- Inheriting assets: If you receive an inheritance, updating your estate plan to reflect your current assets is crucial.

- Divorce: If you go through a divorce, it’s essential to update any previous estate plans made with your former spouse.

- Grandchildren or births in the family: New additions to the family should prompt updates to your will or trusts to ensure their well-being.

Estate Planning Documents: Guardianship Nomination

When it comes to nominating a guardian, it’s wise to start thinking about it as you prepare to have your first child. Although it may not be a pleasant thought, getting it in writing is crucial. It is usually done together with your Will. If you’re working away from your home country and your choice of permanent guardian is a family member or close friend 1000 miles from you, then it’s wise also to nominate a temporary guardian in the territory in which you reside. Doing so will stop local laws from taking over and the children from being taken into care if the worst should happen.

Estate Planning Documents: Will

Making a will is best done as soon as you become a legal adult or when any of the above estate planning triggers occur. Unfortunately, many people pass away without a valid will, leaving family members with the added burden of making important decisions during their time of grief. A will allows you to appoint a healthcare proxy, designate a power of attorney, and specify how your assets will be distributed.

Estate Planning Documents: Trusts

Are you a high-net-worth individual with substantial assets, such as property and investments? It’s time to consider creating a trust. By establishing a trust, you gain control over the distribution of your assets during your lifetime and after your death. Plus, it can help you avoid the lengthy and costly probate process. Read these posts to understand the different types of trusts or contact Soteria Trusts to discuss your options.

Estate Planning Strategy: Inheritance Tax Planning

Are you a UK citizen or a foreigner owning UK assets? Don’t overlook inheritance tax (IHT). IHT is a tax on your estate, including your money, possessions, and property, that is paid after you pass away. Currently, IHT is applied to estates valued above £325,000, but this threshold may change in the future. Anything over this threshold is taxed at 40%, unless you’re leaving it to your surviving spouse, in which case no IHT usually needs to be paid.

It’s important to note that IHT applies to worldwide assets of UK Nationals who are resident or domiciled there at the time of death, as well as the UK assets of those living abroad or deemed non-domiciled at the point of death. This means that if you’re a UK citizen, living in the UK at the point of death, and you have a holiday home abroad, it will still be considered part of your estate for IHT purposes. Similarly, if you’re a foreign national with UK property or assets, you will be liable for UK inheritance tax if their value exceeds the £325,000 limit.

Plan ahead and ensure that your beneficiaries receive as much of your estate as possible. Seek the advice of an advisor to navigate the complexities of IHT and minimize its impact on your legacy.

Estate Planning Documents: Lasting Powers of Attorney

When it comes to estate planning documents, Lasting Powers of Attorney (LPA) are often overlooked but essential. At any given moment, you may suffer from an accident, illness, or incapacity and without an LPA, your finances and healthcare decisions can be left in the hands of someone unfamiliar with your wishes. An LPA allows you to appoint a trusted individual to make decisions on your behalf if you cannot do so. Additionally, without an LPA, your family may need to go through a lengthy and expensive court process to gain authority over your affairs. Give yourself peace of mind by considering an LPA today.

A GUIDE TO LASTING POWERS OF ATTORNEY IN THE UK AND HONG KONG |

When to Update Your Estate Plan?

Life is full of milestones that impact your wealth and how you want it to be distributed after your passing. It’s crucial to update your estate plan each time you approach one of these milestones. Life can be unpredictable, and proper planning ensures your wishes are consistently reflected. As a general rule of thumb, revisit and update your estate plan every three to five years – more frequently if your estate is complex or spans multiple jurisdictions.

Protect Yourself, Your Family, and Your Future: The Importance of Estate Planning

Estate planning is vital to safeguarding your loved ones and securing your legacy. Whether creating a Will or designating a guardian for your children, taking action can ensure that your wishes are honoured after your passing. When you reach significant milestones, consider exploring your options and updating your estate plan accordingly.

Do you have a question about when to start an Estate Plan that we didn’t answer? Contact us today for a no-obligation consultation about your estate planning needs.