More people pay IHT, HMRC data shows

Please be advised that the information in this article regarding QNUPS and IHT is no longer accurate due to the recent changes announced in the UK Budget. Starting in April 2025, the regulations will have significant implications that may affect your understanding of these topics. We encourage you to stay informed and consult with a Soteria Trusts expert to navigate these changes effectively.

It’s no secret that the inheritance tax threshold hasn’t been changed in years, ultimately leaving ordinary families with a large tax to pay. But what you may not know is that this number is only going up – and fast.

More families fall into the Inheritance Tax net

HMRC data shows that an increasing number of people are being caught in the inheritance tax net, as the value of estates rises. In fact, in 2019-2020, a total of 23,000 estates – an increase of 900 estates since the tax year 2018 to 2019 – had to pay inheritance tax.

‘’IHT receipts received by HMRC during the financial year 2021 to 2022 were £6.1 billion. This was an increase of 14% (£729 million) in the financial year 2020 to 2021 and is the largest single-year rise in IHT receipts since the 2015 to 2016 financial year, when receipts rose by 22% (£848 million).’’

Also, the tax bills themselves have increased: the average inheritance tax bill was £266,000 in 2022, compared to £216,000 two years ago, and just £197,000 in 2018.

This news comes as a shock to many, as the tax was previously only affecting the wealthiest families. But with estate values on the rise, more and more people are finding themselves having to pay this hefty bill.

There has been some discussion about increasing the threshold for inheritance tax, but so far there has been no change. This means that families all over the country may be struggling to pay their taxes this year.

Why was the inheritance tax introduced?

The inheritance tax was introduced in order to prevent the accumulation of wealth and power within a single family. At the time, many people were able to avoid paying taxes on their estates by giving them away to their children before they died. The government felt that it was unfair for a small number of people to control a large proportion of the country’s wealth, and so they introduced this new tax to redistribute some of that money.

Without the inheritance tax, the rich would be able to pass on their wealth to their children, while the rest of us would be forced to start from scratch. Of course, people were against the tax, arguing that it was unfair and unnecessary. However, the government stood by its decision, stating that it was important for the country’s future.

Why more families will be caught in the inheritance tax net

The inheritance tax threshold has been set in 2009 at £325,00 or £650,00 per couple, and there are no plans to change it at least until 2026, leaving ordinary families with a large bill that was previously only affecting wealthy families. Since the current threshold was set, inflation in the UK has risen 43.5% and continues to increase rapidly as the cost-of-living crisis takes hold.

The inheritance tax, which takes 40% of assets valued over £325,000 when someone dies, affects more and more families, mainly due to skyrocketing property prices. The beginning of 2009 saw the average prices for houses in the UK at £157,200, while in January 2022, the average house price was approximately £274,000.

If you’ve purchased investment properties or simply have more than one property, then your estate may easily fall in the IHT net. If you decide to sell your investment property, then this will trigger another property tax – capital gains tax.

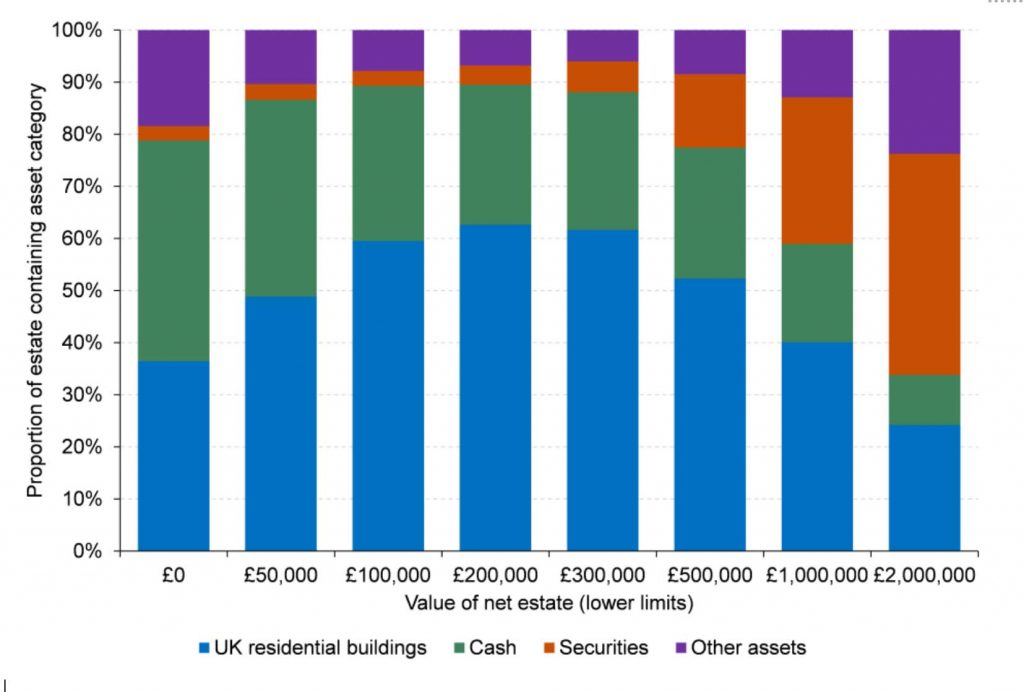

But people’s estates do not only consist of property. Assets such as investments, cash, cars, art, jewelry etc., form the person’s net estate.

Assets by range of net estate value, tax year 2019 to 2020

Source: HMRC

If the IHT thresholds had gone up with inflation, they would stand at £462,330 today, opposed to the current £325,000.

If the nil-rate band had increased in line with inflation, some families may have been able to avoid the charge altogether in previous years. But does this mean that the government is finally going to do something about it? Or will they continue to ignore the issue, letting more and more people fall into this trap?

What can you do to shelter your estate from inheritance taxes?

Instead of waiting for the government to change the rules, there are things you can do to minimize your estate’s inheritance tax bill.

Pass on your main residence to a direct descendant

Current IHT thresholds, known as the Nil Rate Bands, stand at £325,000 per person or £650,000 per couple. There is also an additional Residence Nil-Rate Band (RNRB) of £175,000 per person, or £350,000 when combined with that of your spouse or civil partner, that increases the threshold if the main residence is being passed to a direct descendant of the deceased.

Gift your estate away

You can also give gifts during your lifetime of up to £3,000 per family member in each tax year. These are exempt from Inheritance Tax, but you must live for 7 years after the gift has been given for the gifts to stay IHT-exempt.

Invest in Business Relief

The passing of a family legacy has never been easier with Business Relief. Business Relief is a well-established relief which has been helping people to reduce their IHT exposure since 1976. The purpose of Business Relief is to help family-owned small to medium UK businesses keep going after the death of a business owner. Inheritance Tax is payable also on the business’s value and some trading businesses would not survive if tax was due on the whole value.

Business Relief offers several advantages compared to other existing inheritance tax (IHT) strategies. By investing in shares of those qualified businesses, the shares held in your own name, and the investments become IHT-free after only two years. Furthermore, qualifying investments made under Business Relief will not use up any of your nil-rate band allowance, meaning that this tax-free allowance can be used for other assets such as property.

An inheritance tax-free overseas pension (QNUPS)

Pensions in the UK are largely exempt from inheritance tax (IHT), however, there are limits to your pension size as well as assets you can hold within. This limit is known as the lifetime allowance and currently stands at £1,073,100 for 2021 to 2022.

However, QNUPS, which is a Qualified Non-UK Pension Scheme introduced by HMRC in February 2010, is a regulated tax efficient pension scheme that allows investment into assets in the UK and overseas. Although a QNUPS is a pension fund it does have a degree of flexibility and comes with significant tax advantages.

Assets in QNUPS are IHT-free from day one – meaning you don’t need to wait 7 years for the assets to be IHT exempt like you do with gifts, or 2 years in the case of Business Relief. Moreover, you can hold multiple asset classes in the QNUPS structure – including investment property!

Learn more about this IHT solution during our next monthly UK Property & Tax Seminar. Register below: