Understanding Your Pension Commencement Lump Sum Payout

Please be advised that the information in this article regarding QNUPS and IHT is no longer accurate due to the recent changes announced in the UK Budget. Starting in April 2025, the regulations will have significant implications that may affect your understanding of these topics. We encourage you to stay informed and consult with a Soteria Trusts expert to navigate these changes effectively.

Retirement is a time for relaxation, but it can also bring financial complexities. One of the big questions that often puzzles retirees is the Pension Commencement Lump Sum (PCLS) and whether to take none, some or all when you decide to go into drawdown. Understanding PCLS can be crucial for your financial planning if you’re nearing retirement. In this comprehensive guide, we’ll unravel the intricacies of PCLS, clarify common misconceptions, and provide practical insights to help you make informed decisions about your pension.

What is a Pension Commencement Lump Sum?

A Pension Commencement Lump Sum (PCLS) is a tax-free lump sum that you can withdraw from your pension when you start taking your retirement benefits. It’s often referred to as the “tax-free cash” part of your pension. The PCLS allows you to access a portion of your pension savings without incurring any tax liabilities, making it an attractive option for many people.

By accessing a tax-free lump sum, you can address immediate financial needs, invest in opportunities, or simply enjoy a more comfortable retirement. However, it’s essential to understand that PCLS is not a recurring income; it’s a one amount that be taken at various times.

In the following sections, we’ll explore the mechanics of PCLS, its rules, and how it interacts with other pension components.

Uncrystallised vs. Crystallised Funds

To fully grasp the concept of a Pension Commencement Lump Sum (PCLS), it’s essential to differentiate between uncrystallised and crystallised funds.

Uncrystallised Funds

Uncrystallised funds are the parts of your pension that you haven’t yet accessed. They remain invested in your pension pot, growing tax-free until you decide to use them. This offers you flexibility, as your savings can continue to increase in value, enhancing your overall pension for retirement.

Crystallised Funds

On the other hand, crystallised funds are the portions of your pension that have been converted into retirement benefits, including your PCLS. Crystallising your funds means you’ve activated your pension, allowing you to start accessing the benefits you’ve built up over the years. You can use crystallised funds in several ways, such as withdrawing your PCLS, purchasing an annuity, or opting for drawdown to receive a regular income.

Crystallised funds are tested against the Lump Sum Allowance (LSA) and assigned to provide pension benefits. The LSA for the 2024/2025 tax year is £268,275 and limits the amount most people can take as a tax-free lump sum during their lifetime.

Key Differences

- Access: Uncrystallised funds are not yet accessible, while crystallised funds have been activated for withdrawal.

- Growth Potential: Uncrystallised funds continue to grow tax-free; crystallised funds no longer enjoy this benefit as they are being used for retirement income.

- Flexibility: Uncrystallised funds offer more flexibility for future growth, while crystallised funds provide immediate access to your benefits.

Understanding these differences helps you manage your pension effectively and plan when to crystallise your funds to maximise your retirement benefits, including your tax-free PCLS.

Rules for Taking a PCLS

Maximum Amount

- You can take up to 25% of the total value of your pension pot as a tax-free lump sum. The remaining 75% will be subject to income tax when withdrawn. For those who are overseas at drawdown and using a QROP or QNUP the PCLS can be 30%.

- There is no monetary cap on the PCLS itself, but it is limited by the size of your pension fund. However, if your total pension savings exceed the Lifetime Allowance, currently £1,073,100 (for the 2023/24 tax year), the tax benefits may be affected.

- From 6 April 2024, for those without PCLS protection, the total PCLS available is capped at £268,275 which is the current LSA (Lump Sum Allowance).

- There is a further restriction: the maximum PCLS you can receive when you crystallise benefits is 25% of the amount you’re crystallising at that time.

I Have a Protected Lifetime Allowance. Can I Have More PCLS?

Retirees with a protected lifetime allowance may have the opportunity to receive a higher PCLS percentage, particularly if they had pension arrangements in place before certain legislative changes, including those predating 2006.

These grandfathered provisions allow individuals to retain their original entitlements despite new regulations. If you believe you qualify for a protected lifetime allowance or held a pension with higher PCLS provisions before 2006, it’s crucial to contact your pension provider for confirmation and verify your entitlement. Understanding your specific situation can help maximize your tax-free benefits and make informed decisions about your retirement.

How Does PCLS Work?

The process of accessing your PCLS involves a few straightforward steps. First, you’ll need to notify your pension provider of your intention to withdraw your PCLS. Once your funds are crystallised, you’ll receive your tax-free lump sum, allowing you to use it as you see fit.

While PCLS provides a tax-free advantage, it’s important to consider the impact on your long-term retirement plan. Taking a significant lump sum can reduce the remaining pension pot available for regular income in retirement.

Do I Have to Take a PCLS?

The decision to take a PCLS is entirely optional, and it’s essential to consider whether it’s the right choice for your financial situation. Some retirees may choose to forgo the PCLS to leave more funds in their pension pot for future income.

Before deciding, evaluate your financial needs and goals. If you have pressing expenses or investment opportunities, taking a PCLS may be beneficial. However, if you have sufficient savings and prefer a steady income during retirement, you may opt to leave the funds untouched.

Ultimately, the decision to take a PCLS should align with your overall retirement strategy, ensuring you achieve the balance between immediate financial benefits and long-term security.

Do I Have to Take All of My PCLS at Once?

One common misconception about PCLS is that it must be taken entirely at once. In fact, you have the flexibility to take your PCLS in multiple tranches, allowing for more strategic financial planning.

By spreading your PCLS withdrawals over time, you can better manage your cash flow and tax liabilities. This approach is particularly beneficial for retirees who want to avoid significant changes in their financial situation.

The best approach is to discuss your options with your pension provider and your adviser to understand how partial PCLS withdrawals work.

What if My Fund Value Increases After I’ve Taken My PCLS?

A common concern among retirees is the impact of fund growth on their PCLS entitlement. Fortunately, even if your pension pot increases in value after taking your PCLS, it doesn’t affect your initial tax-free amount.

The PCLS is determined at the time of crystallisation, ensuring that any subsequent fund growth does not alter your tax-free entitlement. This rule provides peace of mind, allowing retirees to continue benefiting from investment growth without tax concerns.

Can I Delay Taking My PCLS?

Yes, you may choose to delay taking your PCLS.

It’s important to note that delaying your PCLS doesn’t result in a loss of entitlement; you have up to 12 months from the time of crystallisation to take your lump sum. Beyond this period, the PCLS will remain in your pension and can be crystallised at a later date.

Imagine your pension is worth £450,000, and you decide to crystallise £200,000, taking a PCLS of £50,000. If you choose to delay taking the PCLS, £150,000 is drawn down, leaving £250,000 uncrystallised. If the PCLS isn’t withdrawn within a year, it’s treated as uncrystallised funds, allowing flexibility in managing your pension.

QNUPS and PCLS

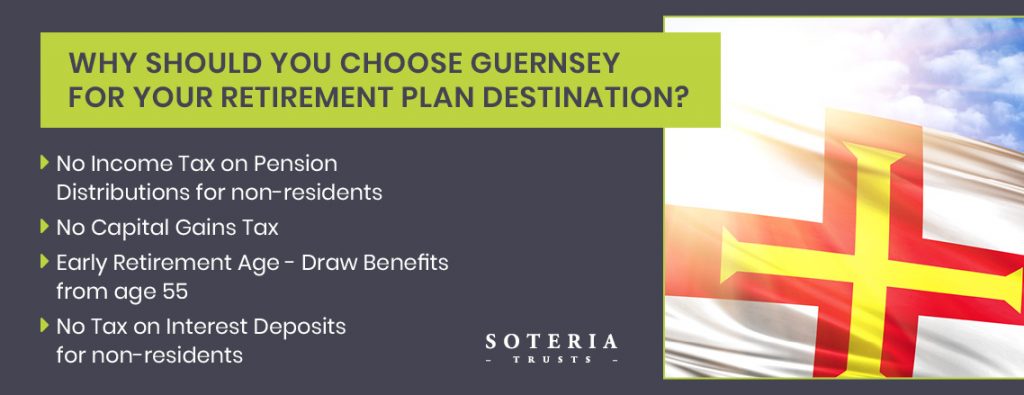

QNUPS is piece of pension legislation introduced in 2006 by HMRC. Any overseas (non-UK) scheme that meets the qualifying criteria can be used as a QNUPS. Depending on your country of residence and the rules of your particular QNUPS, you can take a pension commencement lump sum (PCLS) of up to 30% of the value of the pension fund when you reach retirement age (which varies by the country of where the QNUPS is established).

Learn more about QNUPS

Remember that PCLS is a powerful tool for accessing tax-free cash, but it requires careful consideration to ensure it complements your overall retirement strategy. Whether you’re deciding to take your PCLS, delaying your withdrawal, or maximizing your entitlement, consulting with an advisor can provide valuable insights.

For further resources or personalized guidance, contact Soteria Trusts, who can help you tailor your retirement plan to your unique needs.