What is a Retirement Annuity Contract (RAC)?

Please be advised that the information in this article regarding QNUPS and IHT is no longer accurate due to the recent changes announced in the UK Budget. Starting in April 2025, the regulations will have significant implications that may affect your understanding of these topics. We encourage you to stay informed and consult with a Soteria Trusts expert to navigate these changes effectively.

A Retirement Annuity Contract (RAC) is a defined contribution pension scheme used to save money, which will then be used to provide you with income in retirement. In return for your contribution or investment amount, you can take income in the form of regular payments from the contract, or you can take out a lump sum of up to 30% of the total pension value, known as your Pension Commencement Lump Sum or PCLS, and a reduced income from the remaining 70%. Alternatively, you could enter into an arrangement that sees you receive an annuity until you pass away and from then on, your spouse would receive a reduced amount each year until he or she passes away.

“In the case of a QNUPs, the amount you can take as a regular income from the pension contract is calculated using the plan’s value and is set for a period of three years. This process and formula are repeated every three years using the value of the pension at the beginning of each three-year period.”

How does the Annuity Retirement Contract work?

As per Investopedia: “An annuity contract is beneficial to the individual in the sense that it legally binds the insurance company/provider to provide a guaranteed periodic payment (the annuity) to the annuitant once the annuitant reaches retirement and requests commencement of payments. Essentially, it guarantees risk-free retirement income.”

The RACs are usually set up by self-employed individuals or those who want to have another retirement savings plan to supplement their existing pensions. Members can make regular or lump sum contributions, and under certain circumstances, they can also transfer their current pension to this type of retirement plan.

This traditional form of annuity contract will guarantee income for your life; however, the amount of income payable will depend on the value of the pension fund available at the time and interest rates. Members of the RAC are free to make contributions at any time and manage their investments by themselves or appoint an investment advisor of their choice to do it for them.

If you have dependents who will still rely on your income after you retire or pass away, you will need to name them your beneficiaries in your annuity contract to include provisions for them.

Retirement Annuity Contracts were used as retirement savings in the UK from 1956 up until 1988. During that period, they were the only approved pension type available to the self-employed. No new RACs could be sold from 1 July 1988 in the UK, but contracts in place before that date could continue. UK nationals wishing to save in a RAC can open one outside the UK. One such jurisdiction which is close to the UK is Guernsey; others are Malta & Gibraltar.

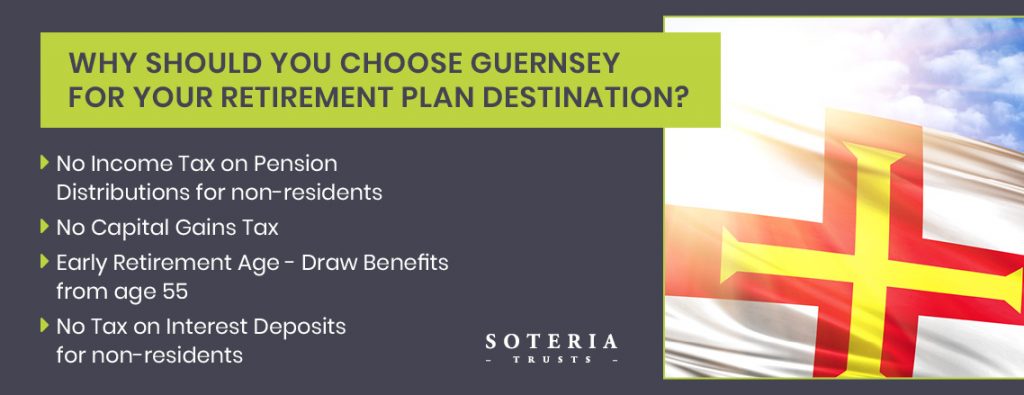

Benefits of Guernsey Retirement Annuity Contracts

Contributions paid to RACs that are set up in Guernsey, such as the Soteria Plan, are eligible for certain tax reliefs to non-residents of Guernsey. The primary benefit is that contributions into the RAC, whether they are transfers from existing pension plans or regular payments, are free from Guernsey Income Tax. While remaining in the RAC, any income derived from investments is also exempt from Guernsey Income Tax. What is particularly important to UK Nationals is that no Inheritance Tax is charged on the Guernsey RAC.

When you retire, you can take the pension commencement lump sum of up to 30% (or 25% for UK residents) of the value of your retirement pot, which will be tax-free, and if you choose to draw more, the remaining amount would be taxable.

Benefits for UK Nationals & Non-UK National with assets in the UK

The Soteria Plan is not set up in the UK – it is set up in Guernsey. Guernsey prides itself as a place with the most modern and rigorous international finance and pension standards. The Soteria Plan in Guernsey also meets the UK criteria of being a Qualifying Non-UK Pension Plan (QNUPS), and this means that it remains outside of your estate and is exempt from UK Inheritance Tax for UK-domiciled individuals.

How are benefits paid out after you pass away?

In the event of the plan member’s death, the value of the assets held in Soteria, minus any outstanding administration fees, will be paid as per their nomination of beneficiaries’ instruction or letter of wishes. For UK-Nationals and any non-UK Nationals who have UK assets that are worth in excess of the Nil Rate Band, the whole pension fund will be outside of their estate and IHT-free.

Alternatively, should one of the beneficiaries want to replace them as the member and, in doing so, keep the value of the fund’s assets outside of their own estate, they can do so. This is a wise and obvious choice for some as it turns the pension into a perpetual legacy planning vehicle that is both cost—and tax-efficient for the next generation and maybe even generations to come.

Benefits for US Nationals

The Soteria Plan has been designed to incorporate the particular requirements of US-connected people and US taxpayers who join it. Assets held within the Soteria Plan grow tax-free, and any proceeds are paid out gross.

Is Retirement Annuity Contract the right choice for you?

Selecting the most appropriate retirement plan is complex and may vary over time as circumstances change. It is, therefore, important to take specialist advice when planning your retirement. Contact one of the retirement specialists at Soteria Trusts today and find out what’s right for your retirement objectives. We can help you determine the size of the retirement fund needed to provide you with the income you desire and help you choose the best retirement plan option based on your nationality and intended retirement jurisdiction.