When is the right time to start Estate Planning?

Have you taken the time to consider what will happen to your assets and belongings after you pass away, or if you become incapacitated? This question is crucial to ask and address, despite not being pleasant to think about. With so many things in life being unknown, financial advisers recommend starting estate planning as early as possible and updating the plan every three to five years as assets and liabilities accumulate. It’s also important to remember that even if you are single, you can, and should plan your estate’s future.

Start Estate Planning sooner rather than later

Research indicates that over 30% of people only start to consider their succession plan after they reach the age of 55 or over. For some families, this may be too late. Starting sooner rather than later gives you and your family time to have those awkward succession planning conversations, work out the finer details, understand the options, and identify the right choice for you all.

Before you start

Understand your position

Are you deemed a UK domicile? Do you have an existing Will? How much income do you require to see you through the remainder of your life? What is the total value of your estate? And which assets do you have access to now? Knowing where you stand for IHT purposes is a helpful tool for laying the foundations of your legacy plan and can be as straightforward as making a list of your assets, incomings and outgoings, or speaking to your financial adviser, accountant and/or solicitor.

Know your motivations

Be clear with your vision and your ‘whys’. What is your motivation for creating a succession plan? How do you want your wealth to be distributed and used? Do you want to create a corporate legacy and ensure that the business is being passed on from generation to generation? Do you want to ensure you leave as much of your estate to your loved ones through tax mitigation strategies? Or is philanthropy and funding charitable research or support your wish?

Write or revisit your Will

Having a current Will is crucial to creating a viable legacy and succession plan. Remember to review your Will at the point of every ‘big life event’, such as marriage, a death in the family, divorce, subsequent marriage, a new child or grandchild, a business exit, or retirement.

When is Estate Planning necessary?

While planning for one’s estate is advised to be done on a regular basis, and as early as possible in one’s life, there are certain life events when Estate Planning becomes a necessity. Here are some of them.

A savings account or pension

As soon as you start a savings account or start receiving pension contributions, a natural next step is to designate where those funds would go in the event of your death. This will ensure the account can be passed on to a loved one or cause of your choosing.

Home and additional property

The purchase of a home or other property is a sign to start estate planning, as you most likely want to avoid lengthy probate court proceedings and Inheritance Tax liabilities.

Marriage

Combining assets will increase your estate’s overall value, and this is another cue to start estate planning. Take time to determine what happens in the event of one spouse’s death, as well as both.

Divorce

If you get divorced, it becomes essential to update any previous estate plans that were made with your former spouse.

Children

One of the most apparent estate planning necessities is the birth of a child. You need to think about guardianship and financial security in case anything were to happen.

Inheritance of money or other assets

An inheritance can be very sudden and provide you with more assets to take care of. Update your estate plan to reflect any additional money or other assets you inherit when you can.

So, when is the right time to start Estate Planning?

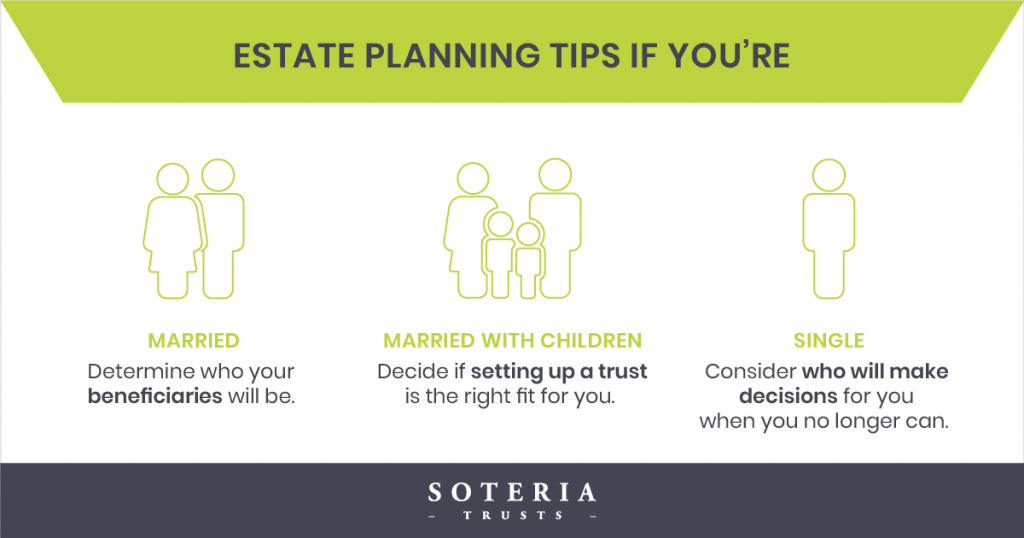

Putting up a simple estate plan for when you’re a single 30-years old is a good start as even at that age, you have assets, life policies, pensions or maybe even your first property that you don’t want to be difficult to access by your loved ones. Moreover, setting up a Power of Attorney at this age is a good way to ensure someone trusted can make decisions for you in case that you can’t.

For married couples and those with children, their estate planning should be more comprehensive, and as we mentioned earlier, revised regularly as their lives and circumstances evolve and change. This group should think about their children and how to ensure their guardianship and financial future with more advanced estate planning strategies.

Don’t do it alone

There are many different options available to those looking to plan their estate, and you should not discount any of them without first speaking to one of our specialist advisers. We often meet many people who think specific solutions are not available because of confusingly worded legislation or media portrayal. This way, you can ensure your family is wholly protected and without uncertainty when you die.